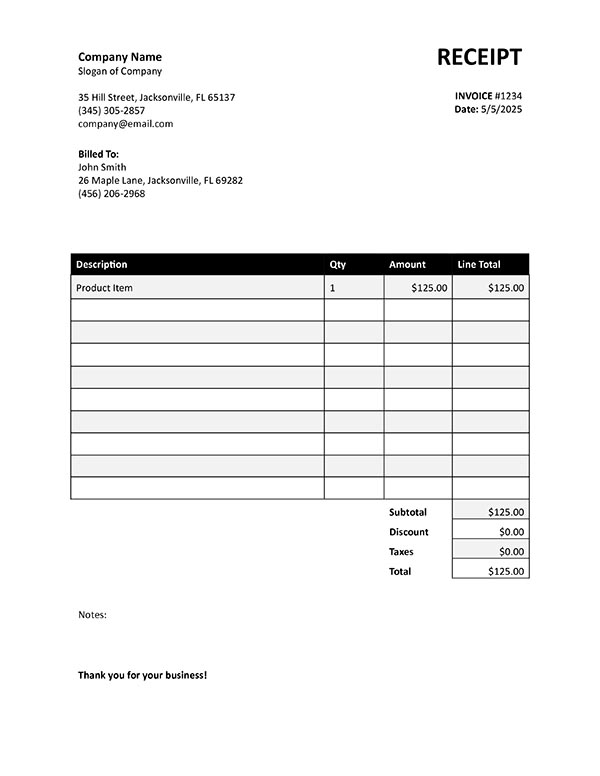

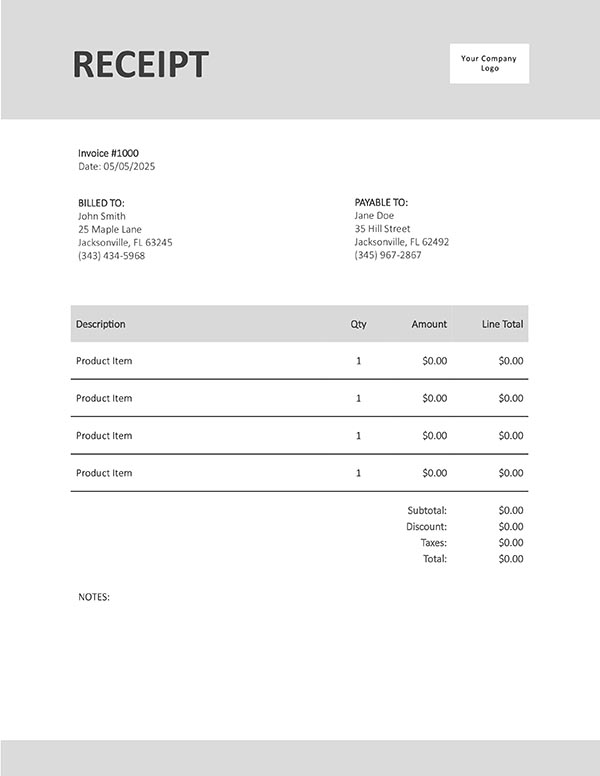

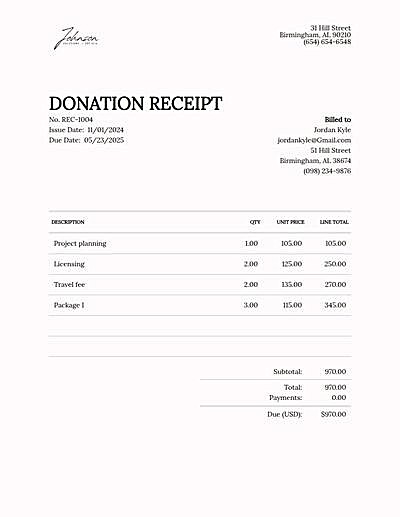

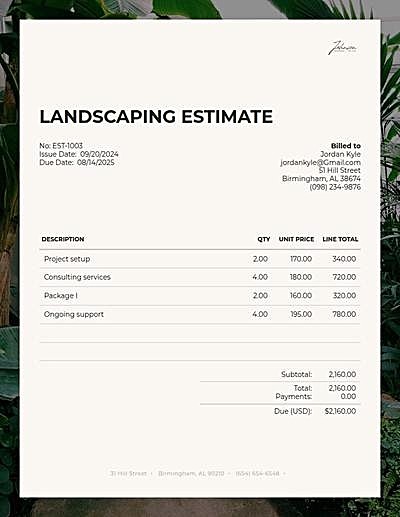

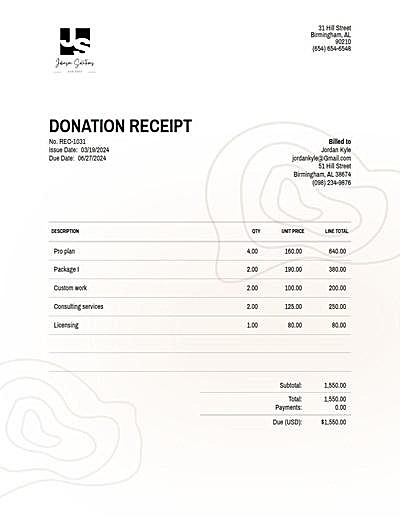

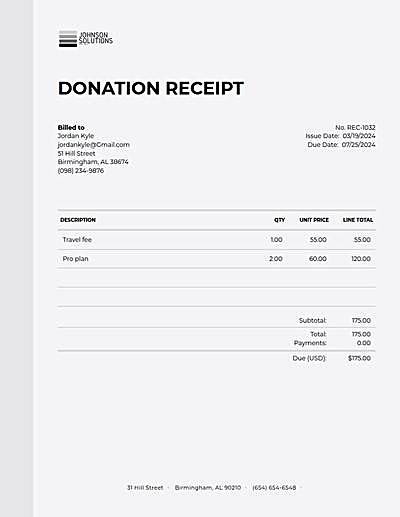

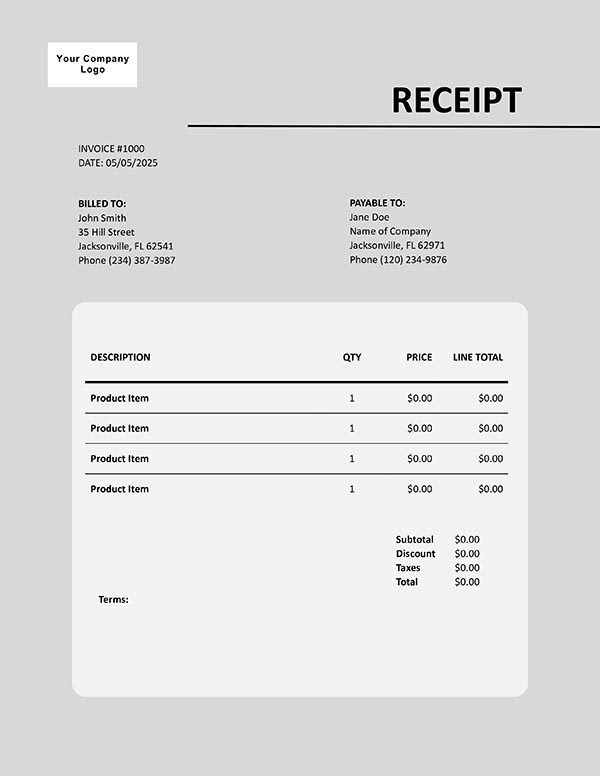

Donation Receipt Templates

Need more than a download?

Easy online invoicing: customize, send and get paid.

What is a 501(c)(3) Donation Receipt?

Prep and send a customized donation receipt in minutes. Download one of our snazzy templates or give our free online receipt generator a whirl.

When someone donates to a qualified charity, they'll get a special receipt called a 501(c)(3) donation receipt. It's basically a formal way to say "thanks" for their generosity and serves two important purposes:

- It's like a financial handshake: This receipt proves the donation happened, both for the donor's records and for your organization's bookkeeping.

- Helps with Taxes: For some donors, this receipt can be used to claim a tax deduction when they file their tax return.

It's a win for everyone! You get to thank your amazing donors, and they have documentation for potential tax benefits.

Building a Strong 501(c)(3) Donation Receipt: Must-Haves!

A great donation receipt shows your appreciation and keeps things clear for everyone. Here's what to include:

- Your Charity's Name: Make sure it's clear and matches your official records.

- Donation Date: Include the date the donation was made. This helps your donor prove it to the IRS for tax purposes and helps you keep track of your records. Plus, knowing the date lets you send a personalized thank you note at the perfect time (or a gentle reminder if a response is overdue).

- Donation Amount: Clearly state the amount of money donated, both as a number and written out (like "$100" and "One Hundred Dollars"). This avoids any confusion.

- "No Goods or Services Provided" Statement: This is important! It clarifies that the donation was a gift, not a payment for goods or services.

By including these details, you create a professional and accurate donation receipt that keeps everyone on the same page.

What is Not Considered a Deduction?

It's important to know that if a charity gives you something in return for your donation (like a t-shirt or tickets to an event), the value of that item is usually not tax-deductible. Here's the deal: you can only deduct the amount you DONATED that's GREATER THAN the value of the gift you received.

For example, if you donate $100 and get a t-shirt worth $20, you can deduct $80 from your taxes.

So, the key takeaway is: the more you donate compared to what you get in return, the bigger the potential tax benefit!

How Do I Create a 501(c)(3) Donation Receipt?

We know, saying "thank you" to your donors is essential, but wrestling with receipts can feel like, well, a chore you'd rather avoid. But say goodbye to the old ways, because now you can easily customize user-friendly templates to fit your charity's needs!

- Online Tools to the Rescue: Online tools and templates can make creating donation receipts painless.

- Invoice Generator Magic: Invoice generators (like the one from Invoice Candy!) offer pre-made templates you can customize to fit your charity's needs.

- Simply Fill in the Blanks: Just add the key details, like the donor's name, donation amount, and date.

- Print and Send: Generate a professional-looking receipt in seconds, ready to print or send electronically.

With online tools, creating compliant donation receipts takes no time at all.

Tips for Using Donation Receipts

Saying "thank you" to your donors is crucial, and donation receipts are a powerful way to do it. Here are some tips to take your receipts from ordinary to extraordinary:

- Be Timely and Accurate: Get those receipts out fast, with all the correct information. It shows you appreciate the donors generosity and helps them with taxes.

- Record Keeping Like a Boss: Keep clear records of donations and their receipts. This is important for taxes and audits, and keeps you organized.

- Consistency is Key: Make sure your charity's name and details are always accurate and match across all documents. No confusion here!

- Empower Your Donors: Let your donors know how important it is to keep their receipts for tax deductions. It's a win-win!

- Donors, Don't Trash Those Receipts! Remind them to hold onto their receipts; they could save money on their taxes come filing time.

Bonus Tip: 501(c)(3) donation receipts aren't just boring paperwork. Use them to show some love to your donors, build trust, and keep spreading those good vibes in your community! Online tools like Invoice Candy can make creating and managing receipts effortless. This frees you and your team to focus on what matters most – your mission and the amazing people who support it.

Frequently Asked Questions

Donation Receipt Templates FAQ

Wondering when you need to give a receipt? The IRS usually doesn't require one for cash donations under $250 for tax purposes. But here's the thing: It's always a good idea to keep track of every donation, no matter the amount. This helps with your records and shows appreciation to your generous donors!

Non-cash donations of property or stock are awesome! But figuring out the value of a receipt can be tricky. Here's the deal:

- Tricky to Price? Get a Pro: For donations over $5,000, you will need a formal appraisal from a qualified appraiser. They can give you an accurate value to put on the receipt.

- Under $5,000? You Might Be Okay: For smaller donations, you might not need a formal appraisal. But it's always a good idea to do some research to determine a fair value.

The key is to have a clear idea of the donation's worth so you can provide an accurate receipt. This shows appreciation to your donor and helps them with potential tax deductions.

For donations of $500 or more, your generous supporters need to report the full amount on their tax return, even if they received something in return (like a fancy dinner at a fundraising gala). It's important for them to keep good records, and the receipt you provide will make this easier!

Excel

Excel

Word

Word